If you have any questions that aren't answered, please contact us on [email protected] or phone 03 543 8400.

The back of your rates invoice will detail each of the rates you are charged.

The annual rates requirement for each rate type is determined through Council's Annual Plan or Long Term Plan process.

Once the total rates revenue is determined, it is apportioned out to individual properties based on the rating factor the rate is charged on. This may include land value, capital value, per rating unit (property), etc.

Details of what each rate is for and what the rate funds are listed in our Funding Impact Statement.

How you are rated varies depending on where you live, what services you can access, and the value of your property. Council does not determine the value of your property. Valuations are carried out by an independent valuation company and approved by the Office of the Valuer General. Council then applies this information to set its rates.

Many of Council's targeted rates are charged to properties within a certain rating area. A targeted rate is designed to fund a specific activity or function. If your property is within the rating area, you will be charged the rate. The rating maps are included in our Funding Impact Statement.

Many of the Council’s targeted rates are charged to properties within a certain rating area, including the stormwater rate. All properties in the district pay a stormwater rate, with those included in the Urban Drainage Rating area paying a higher rate than those in the general district area.

The stormwater rate funds the stormwater activity including capital improvements and maintenance costs which are for the benefit of all road and property drainage that is required in urban areas. A function of the stormwater activity is to minimise the risk of flooding of buildings and property. The rating maps are included in our Funding Impact Statement.

In most cases, the owner of a property rather than the occupier is the person responsible for ensuring the rates are paid. The occupier will only be included on the rates invoice if the long term lease is registered on the certificate of title.

In most cases a rating unit is the area specified in the Certificate of Title. Exceptions may apply where a property is used as one farming operation, a significant improvement straddles the boundary of two titles or where the titles are legally required to be sold together.

Council's policy included in the Revenue & Financing Policy is that the whole district should contribute funds to a range of infrastructure assets irrespective of their location and the population they serve.

Through a club approach, all members will share in the costs and benefits of paying for each other's infrastructure and services which helps provide more certainty and affordability to rates and helps ensure consistent levels of service across the district.

The Urban Water Club includes the Supply of all metered water in the district to Brightwater-Hope, Collingwood, Kaiteriteri-Riwaka, Māpua-Ruby Bay, Murchison, Pōhara, Richmond, Tapawera, Upper Tākaka & Wakefield. It also includes the rural extensions that feed off the urban supply in these communities, where applicable.

Funding for the Urban Water Club is also received from certain customers in the Nelson City area that are supplied water by Tasman District Council, as well as several large industrial users. At the moment, the Motueka community has not opted to join the Urban Water club.

The shared facilities rate funds regional facilities that are used by many residents of both districts.

The Local Government (Rating) Act 2002 requires a lot of different information be contained on your bill to provide transparency. If you do have any questions about how to read your bill, get in touch with us.

We may not have received the Notice of Change of Ownership. Please contact your solicitor in the first instance.

You’ll still need to pay your rates on time to avoid penalties. You may wish to sign up for a direct debit, or see payment details on your first instalment and arrange payment in advance.

If you are having difficulty paying your rates and have rates arrears, we may be able to enter into a payment arrangement by direct debit with you, you can find our direct debit form here. If your request for a payment arrangement is successful and the payments do not default, you will avoid incurring future penalties and may be eligible for a remission of some penalties recently incurred.

Direct debit payment options include weekly, fortnightly, monthly and quarterly payment options, which may assist in managing your cash flow. You can complete your application online.

If you are unable to keep your rates account up to date, we are able to collect all arrears through either enforcement via your mortgage provider, or by legal proceedings through the courts. We'd like it if that didn't happen, so please contact us - we will work with you to get it sorted.

Rates are set each year as at 1 July. The four instalments are in place to spread the rates through the year.

Phone the Customer Services team on 03 543-8400 or email [email protected] to request a copy.

We're legally required to send out an invoice and assessment. We send invoices quarterly. The account is for your information only and will state that it is to be paid by direct debit.

As a property owner, you should be aware that rates are paid quarterly. If you notice that an invoice hasn't arrived, please contact us to ensure the correct address is on file and to request a copy of your invoice.

You may wish to sign up for direct debit to avoid missing future payments.

If you do receive a penalty, you may be eligible for a remission (waiver/reversal) of this penalty.

The information held on the rating database is as per the Certificate of Title. You can contact your solicitor if you need to change information on a rates account due to a death or marriage. The Council will process the change upon receiving a Notice of Change of Ownership.

Yes.

Yes- you can email [email protected] to have your postal address updated quoting relevant valuation assessments and water accounts that need to be updated.

Please let us know whether the address change applies to all accounts held with us, and also whether addresses of any rates joint owners will also change.

You can also fill out the change of address form on the remittance part of your rates invoice and drop at a Council office.

Generally the owner will still need to be invoiced and pay for the rates. It is then up to the owner to recover the rates from the lessee. An exception may apply for a lease that is registered on the title. These are long term leases that are at least 10 years long.

Valuations are undertaken every three years on behalf of Council by Quotable Value ("QV"). When the valuations are released, you are given the opportunity to object directly with QV before they are finalised and used for setting the rates.

If you do have questions between objection periods, please contact QV directly on 0800 651 133.

If you have applied for a building consent, we will automatically notify the Council's valuer, Quotable Value (QV). QV will review the value to reflect the work carried out under the building consent. In this case you will be notified of any value changes in due course.

If you have done new work that does not require a building consent your property values may or may not be impacted depending on the nature and extent of the work that has been done. QV can only review the values if they are aware of this work so please contact QV directly on 0800 651 133 to determine whether your value needs to be revised.

If the value changes, your rates will change from 1 July the following year.

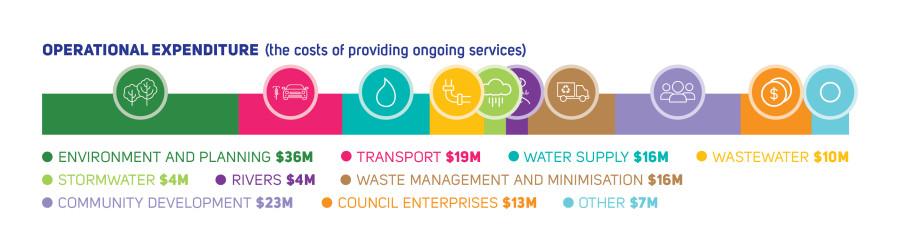

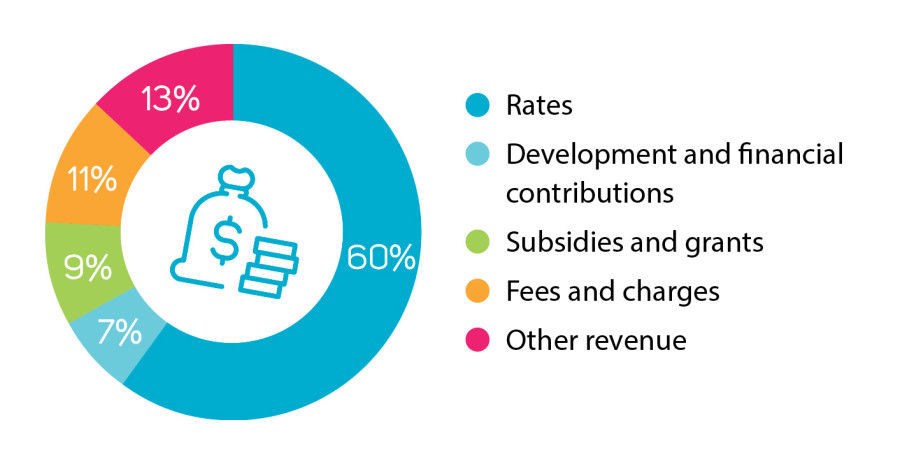

Rates are used to pay for a wide variety of Council-provided services including changes driven by external cost pressures.

The main factors that have contributed towards increased Council costs and contributed to a rates revenue increase excluding growth of 11.1% are described below:

We may not have received the Notice of Change of Ownership. Please contact your solicitor in the first instance.

No - apportionments are done by solicitors at settlement. Please ensure your solicitor notifies us of the sale or transfer.

Your solicitor should request a special meter reading, and the final water bill must be paid as part of the settlement process.

We will cancel the direct debit at the advice of your solicitor, or you.

The direct debit is not transferred to another property, so if you're moving to a new property in the district, you will need to complete a new direct debit form for that property.

Contact the rates team to check that a notice of sale has been received to show you are the new owner. If we have not received one, then you will need to contact your solicitor.

If a property is subdivided or resurveyed during a rating year, the assessment details will remain unchanged until the start of the next rating year in July. We request you clear the rates for the entire year before we process the subdivision.

Common situations where a property owner needs to use a solicitor to complete a Notice of Change include:

The rating information database includes information such as the property location, valuation number, capital and land value, and current year rates.

If there are any incorrect details in the rating information database please advise the Rates Officer as soon as possible by emailing [email protected].

Section 28A of the Act states that the local authority's complete rating information database, which includes the names and postal addresses of the owners of rating units must be available at the public office of the authority. However as a property owner, you do not have to display your name and mailing address in the public database.

Our rating information database is also available for you to view during office hours at Council offices. This information if updated once a year and a public notice is issued in May to let you know this.

Yes, simply return the application form to [email protected]. You can also hand it in to an office

Since 2018 Motueka ratepayers connected to the reticulated network are charged a fixed service fee.

This fee contributes to $5.9 million of water quality improvements needed to make sure Motueka’s water supply meets compulsory national drinking water standards.

There are several payment options available - including electronic banking and direct debit.

Please ensure you use the appropriate valuation reference (i.e. valuation number for rates or water account number for water) to ensure your payment is applied to your account.

Bank details for refunds must be provided in writing or by email. You can email through your request for a transfer to [email protected].

We'll review the request. It's possible to transfer overpayments to other accounts you have with balances owing.

Yes. Apply via our online form or email through the new form to us at [email protected] or complete a new form and return it to one of our offices.

No - simply email [email protected] or call us to let us know. We will send you a written confirmation.

You can email [email protected] or call us on 03 543-8400.

A Rates Remission allows us to effectively "remit" or reverse a portion of your rates charges. We may remit rates in a number of circumstances, such as reducing rates for certain community organisations.

Yes, generally you have to pay rates on all the properties, however you may pay less rates. Properties can be deemed to be in common ownership if all of the following criteria are met:

Owned by the same person/persons (exact same person or persons on the certificate of title), and

Used jointly as a single property, and

Contiguous or separated only by road, railway, drain, water race, river or stream.

If two or more properties are in common ownership and meet the above criteria, certain rates that are set per property or rating unit, will only be charged one time. If your property qualifies for this treatment, please apply online or complete the PDF form and send through to the rates team.

Rates rebates are a subsidy to assist lower income earners with the cost of their rates.

To be eligible for a rates rebate:

The amount of any rates rebate is based on three factors:

The amount of your annual rates levy.

The total income received by you and your partner.

The number of dependants residing on the property.

The maximum rebate for the 2024/2025 year is $790. Visit the Department of Internal Affairs link below under the "are you eligible" heading- and use the "electronic calculator" to see if you're eligible.

These rates pay for work associated with the dam to provide a secure water supply to communities in Richmond, Brightwater, Māpua and rural areas of the Plains.

Access to an augmented water supply has economic benefits for the wider Tasman District. Improved flows in the Waimea River are better for the environment and enhance recreational opportunities.

The Council have established a differential rating system under local government rating legislation. This gives the Council discretion to determine the most effective rating system. There is no ‘right of appeal’ in relation to the choice of the system or the level of the rate.

We applied the following principles to determine a boundary for the Zone of Benefit (ZOB) rating area:

The process of defining the boundary for the Zone of Benefit was not a prescriptive, scientific one, but one based on principles. In setting the rating area, inevitably some properties fall close to the zone boundary, and others are just over the boundary. The Councillors have determined where the boundary lies, but by its very nature is a proxy for benefits received, there was judgment required in where the line ultimately fell. This was the subject of submissions in the 2018-28 Long Term Plan and remains in the 2021-31 Long Term Plan.

It should be noted that rates are a property tax covered by prescriptive legislation. Non-payment of rates leads to a statutory process that includes financial penalties, amongst other remedies.

Last modified: